Daneric Elliott Wave: Trading Strategies & Insights

Is the Elliott Wave principle, named after Ralph Nelson Elliott and then Daneric Elliott, a reliable tool for predicting market movements, or is it merely a sophisticated form of technical analysis that offers little practical advantage? The enduring popularity and frequent use of the Elliott Wave Theory by experienced traders suggests that it holds genuine value in understanding and potentially anticipating market behavior.

The allure of the Elliott Wave principle lies in its attempt to frame market fluctuations as a reflection of underlying investor psychology. Elliott posited that stock prices, like any natural phenomenon, move in specific, recognizable patterns. These patterns, he argued, are driven by recurring waves of optimism and pessimism the emotional tide of the market. Identifying these waves, and their inherent structure, provides a roadmap for anticipating future price action. While many have taken the original theory and evolved it into different forms, each one is linked to the same concept and underlying foundation.

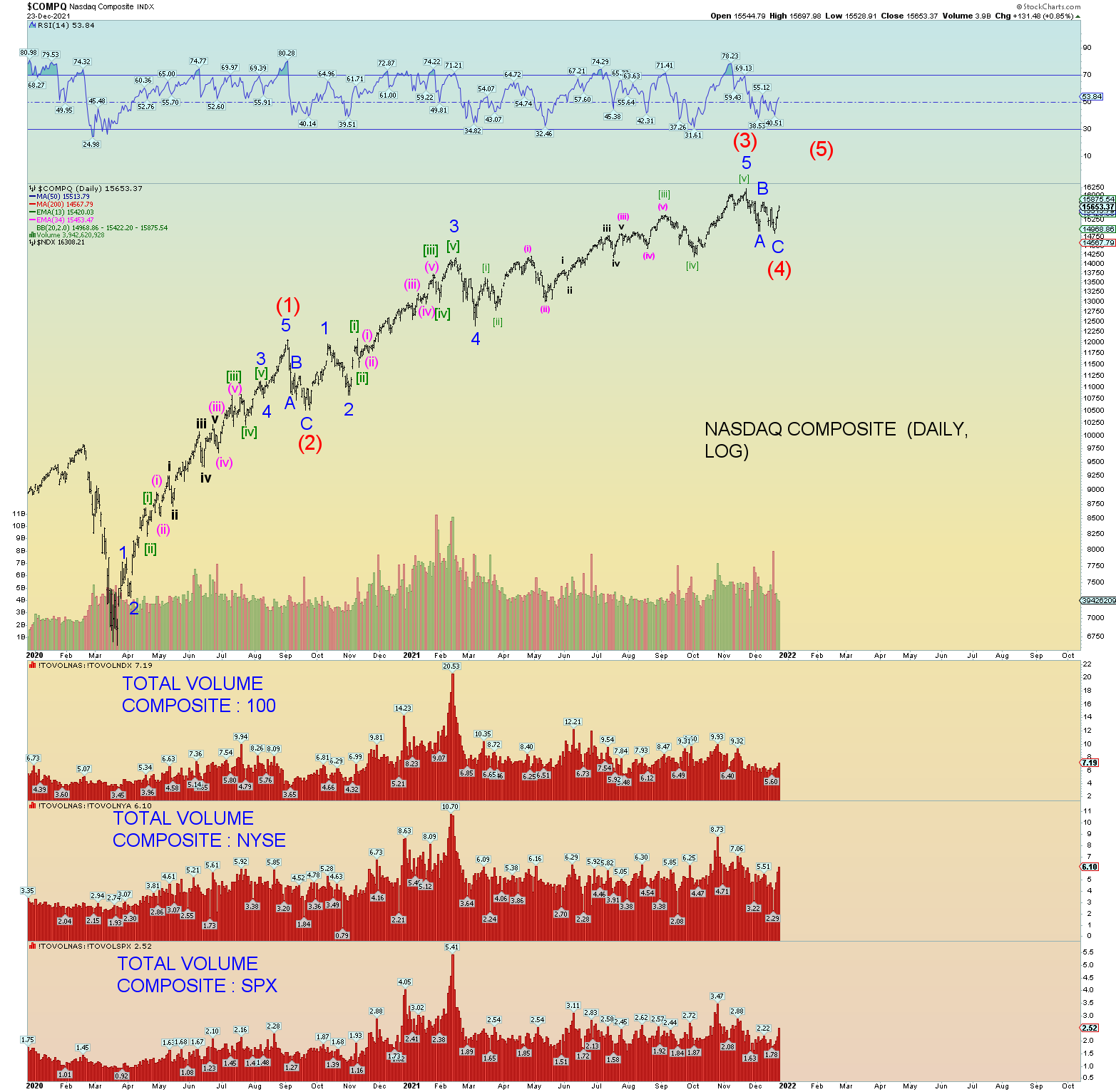

The core concept of Elliott Wave theory revolves around the idea of waves, categorized as either impulse or corrective. Impulse waves, which move in the direction of the main trend, are composed of five sub-waves, with three trending in the primary direction and two retracing. Corrective waves, acting against the primary trend, consist of three sub-waves and are often more complex and varied in their structure. Determining the length and the shape of the wave formations are the most useful for investors to keep the waves in perspective.

The Elliott Wave Theory provides a framework for understanding price movement in the financial markets. Its principles are applied to many fields, and it's known that they can be used to determine a wide range of patterns, and there are different variations of Elliott Wave patterns. Here's a breakdown of some common patterns and their significance:

- Impulse Waves (5 Waves): These waves move in the direction of the main trend and are generally associated with bullish or bearish market trends.

- Wave 1: Initiates a new trend and can be hard to identify.

- Wave 2: Retraces a portion of Wave 1 but should not fully retrace it.

- Wave 3: Usually the longest and strongest wave in an impulse sequence.

- Wave 4: Corrects Wave 3 but should not overlap with Wave 1 territory.

- Wave 5: Completes the impulse sequence, often with a divergence in the RSI indicator, in comparison to Wave 3.

- Corrective Waves (3 Waves): These waves move against the main trend, counteracting the impulse waves.

- A: Begins the correction, often a sharp move downward.

- B: A rally or retracement, often misleading.

- C: The final wave of the correction, usually a sharp move in the direction of the main trend.

The complexity of the Elliott Wave can also make it challenging. The theorys subjective nature means that different analysts may interpret the same chart differently, leading to conflicting forecasts. The wave is one of the best market tools to use, that is why many traders use it. In addition to the basic wave patterns, there are several variations and combinations, that traders should keep in mind. However, as with all forms of technical analysis, the Elliott Wave is not infallible. Market conditions can change rapidly, and unexpected events can invalidate even the most carefully constructed wave counts. The theory should be used in combination with other tools and strategies to improve the probability of success.

The main use of the Elliott Wave is to help investors understand patterns in financial markets, but it is not limited to the same. There are numerous real-world applications of the Elliott Wave Theory in trading. One of the primary uses of the Elliott Wave Theory is in identifying potential entry and exit points for trades. By identifying the completion of a wave pattern, traders attempt to time their trades to take advantage of the next move in the market. For example, a trader might look for the end of a corrective wave (Wave C) to enter a long position in anticipation of an impulse wave. Elliott Wave can also be applied to set profit targets and stop-loss levels. Traders use the structure of the waves to estimate how far the price might move and calculate potential risk.

Further, the theory is a tool for risk management. Understanding where the market is in the cycle allows traders to manage risk more effectively. If a trader believes the market is nearing the end of an impulse wave, he might tighten stop-losses or take profits to protect gains. The Elliott Wave is not a standalone trading strategy. The wave theory provides a framework for understanding and predicting market behavior, and the principle should be used with the use of other forms of technical analysis. Different indicators can be used, such as moving averages, Fibonacci retracements, and oscillators to enhance the accuracy of wave count. This provides a stronger basis for making trading decisions.

The Elliott Wave principles are not just applicable to the stock market. They can be applied to various financial markets, including Forex, cryptocurrencies, and commodities. The fundamental patterns and rules remain consistent across different markets, which can be used to diversify a trading approach. For example, in Forex trading, the Elliott Wave can be used to identify potential trend reversals in currency pairs. When analyzing cryptocurrency markets, which are known for high volatility, the Elliott Wave can help identify key support and resistance levels. It can also provide insight into market sentiment. In commodities trading, this could include price behavior of assets like gold or oil. Many traders use this strategy to diversify their trading portfolio.

Fibonacci ratios are used by the Elliott Wave Theory. Fibonacci retracement levels are often used to identify potential support and resistance levels within a wave. Fibonacci extensions are used to predict the potential targets for future wave movements. Combining the Fibonacci tool with the Elliott Wave Theory helps to confirm patterns and refine trading strategies. It helps traders identify potential entry and exit points for trades based on the Fibonacci levels that correspond with Elliott Wave patterns.

While the concept of Elliott Wave is valuable in understanding market fluctuations, the interpretation and application of the theory require a disciplined approach. Due to the subjectivity of the theory, there are several challenges that traders might come across. The subjective nature of Elliott Wave analysis can make it difficult to apply in a trading environment. Different analysts may interpret the same chart data differently, and this can lead to different outcomes and trading strategies. A high degree of judgement is required to accurately identify wave patterns. The potential for error is always present, even for experienced traders. There is no guarantee that the wave count will play out as predicted. This means that trading outcomes might be inconsistent. Overreliance on the theory, without considering other indicators or market factors, can lead to poor trading decisions.

To reduce these challenges, traders can use a combined approach. Combining Elliott Wave with other tools can lead to more success. Market conditions and events can affect the market, leading to the invalidation of previously analyzed wave counts. Combining other indicators and techniques with Elliott Wave can help reduce the probability of error. This includes technical analysis tools, such as moving averages and RSI, as well as fundamental analysis. The discipline of the Elliott Wave principle in practice is important, and this can be achieved through: consistent application, reviewing past performance, and using other methods such as market news. A disciplined approach includes setting clear trading rules, managing risk effectively, and sticking to a trading plan. Without these skills, traders can find themselves getting lost in the intricacies of the theory.

The Elliott Wave principle, when applied correctly, can offer a powerful advantage in trading the financial markets. By understanding how it functions, how it has developed, and how traders have used it, investors can significantly improve their understanding of how the markets work. This theory should be used alongside other methods and tools, and always be cautious in the application of it.

Ultimately, the success of the Elliott Wave principle rests on a trader's ability to recognize patterns, adapt to changing market conditions, and manage risk effectively. It is not a magic formula, but a tool. It requires a commitment to continuous learning and refinement.